It wasn’t long ago that local news reports shared multiple stories about Hawai‘i’s ports being clogged with container ships that couldn’t unload their goods, or big box retailers with bare shelves. Unprecedented breakdowns in the world’s supply chain caused economic woes both locally and abroad. Few, if any, industry sectors emerged from the pandemic unscathed.

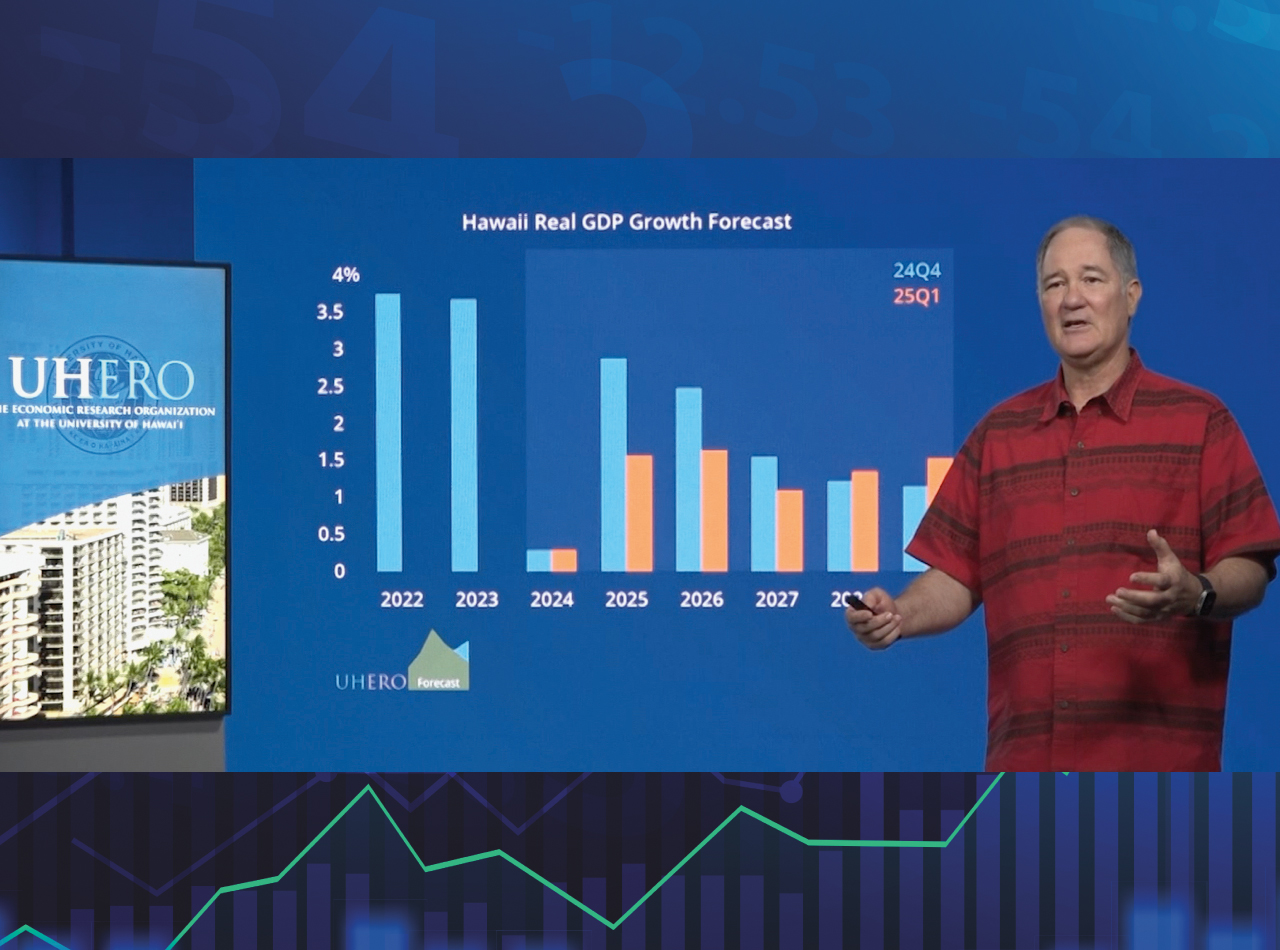

By most estimates, America’s economy continues its rebound from the last few years of turmoil. As this issue goes to press, the S&P 500 just hit an all-time high as inflation rates continue to ease. The U.S. Bureau of Economic Analysis also reports gains in both GDP and personal income for Americans. Yet while several economic indicators show positive movement, supply issues, skyrocketing costs and other economic pressures are still cited as causes for delays among projects statewide.

Local suppliers large and small — and everyone in-between — all have their own takes on the state of Hawai‘i’s supply sector, both as it relates to them individually as well as the overall industry.

Tyler Williams

THE (SUPPLY) CHAIN THAT BINDS US

“Supply chain issues are still a concern but to a lesser degree,” says Tyler Williams, senior director of Honsador Lumber LLC.

While he notes supply constraints haven’t been completely resolved, lead times have slightly decreased — but still remain above average. Williams credits the change to more readily available lumber products and reduced costs since COVID-19. As a supplier, distributor and manufacturer, Honsador has been able to maintain large inventories statewide.

“We produce as much locally as we can to support the local workforce; we treat all our wood at our Honolulu wood-treating facility, build trusses at one of our three Hawaii truss plants, design and package engineered wood systems locally, build cabinets in one of our two cabinet shops [and] prepare doors in our O‘ahu-based door shop,” he says.

Oly Freitas is president of Construction Materials Hawaii (CMH), a supplier of fasteners primarily serving the sheet metal and mechanical sectors. Freitas says CMH continues to experience delays in acquiring materials.

“It takes a month to get some hardware items,” including larger diameter bolts, she says, adding that supply chain issues remain a big concern. Freitas has been with CMH for 47 years, running the company alongside her brother, Rocky, after taking over operations from their parents.

Adam Bauer

At HPM Building Supply, “the availability of supplies has improved significantly in 2023 and is close to or the same as normal pre-pandemic levels,” says Chief Operating Officer Adam Bauer. Like Williams, Bauer sees a stabilized supply chain resulting in more predictable operations going forward.

Bauer says HPM was able to take a proactive approach by shoring up their own supply chain during the pandemic to minimize impacts.

“We carry not only construction materials but also home interior products like cabinets, countertops, fixtures and more,” he says. “We maintain strong relationships with an array of suppliers and partners to be able to reliably source high-demand products and do custom orders at reasonable prices.”

A combination of new facilities and the opening up of relationships with new suppliers and manufacturers allowed the company to be more proactive, Bauer adds.

Pallets of steel, pictured above at an HPM supply yard, sit ready for the next construction project. PHOTO COURTESY HPM BUILDING SUPPLY

OTHER FACTORS

But the supply chain was far from the only problem plaguing suppliers and the construction industry as a whole. While the COVID-19 pandemic exacerbated existing flaws within the supply chain, it also brought its own new set of challenges. The pandemic officially ended in May of 2023, but its effects still linger — and may for some time.

“Many people have left Hawai‘i for other states where their money goes further,” says Williams. Freitas and Bauer also express challenges in finding and retaining employees, with Bauer adding that it’s an industry-wide concern, “from design professionals to tradespeople,” due to Hawai‘i’s decreasing population.

“High rent, jobs awaiting permits,” are two concerns currently weighing on Freitas’ mind. The building permit backlog has been a long-reported issue plaguing the construction industry on O‘ahu.

Additionally, Freitas says inflation has affected how customers place orders. They now “ask for a quote first, [whereas] in the past they just ordered what they needed,” she says.

“It’s just the result of everything that’s happening now. Gas prices, the economy. Everything,” says Freitas.

According to Williams, “high interest rates are making it difficult for people to qualify for a mortgage, [and this] impacts the building industry North American-wide.”

Raising interest rates has been a strategy used by the Federal Reserve to help keep moderate inflation, although it comes with its own set of complications.

“Until these high interest rates start to recede, we will continue to see a dramatic slowdown in the building industry as more projects are either put on hold or canceled,” Bauer says.

PRE- AND POST-COVID COMPARISONS

But has the overall supply situation improved since the onset of COVID? And how does the pandemic compare to previous industry slowdowns?

Freitas has been in the business long enough to remember the real estate market crash of the late 1980s and early 1990s.

“[1989 and 1990] were really, really slow,” she says, noting circumstances today are much better than back then. Freitas laments the closure of “quite a few” of her customers’ businesses towards the end of the pandemic, but adds that it “seems like we are getting back on track.”

“With the exception of staffing, I believe we are moving back to some pre-COVID normality,” Williams says. “The movement to remote work to maintain business during COVID can be difficult for some industries to sustain, especially when faced with a diminishing workforce.”

Says Bauer: “Unlike many sectors, construction remained resilient through COVID with strong continued activity. While remodeling has tapered off somewhat from peak pandemic demand, new home building has remained robust. With the essential need for more housing across Hawaii, new construction remains steady into the present to meet demand.”

Growth is expected to continue in the new year, necessitating a continuing need for building supplies. PHOTO COURTESY HPM BUILDING SUPPLY

LOOKING TO THE FUTURE

Heading into 2024, Bauer sees growth in both new residential and commercial markets.

“While minor slowdowns have occurred in portions of the market, the overall outlook for the building industry is positive and construction does not appear to have suffered major lasting effects from the pandemic,” he says.

While acknowledging staffing issues will remain a concern statewide, Williams sees the potential for bright spots in “long-range affordable housing plans, and ongoing grassroots planning (that will) provide mid- and long-term shelter (and) homes for those (displaced by) the Lāhainā and Kula fires.”

However, he says this will require “expedited planning and processing … in order to move people back to their homes and communities as soon as possible.”

Williams also expresses hope for “continued normalcy in the supply chains, (and the) leveling of costs as continued controls to reduce inflation are implemented.” These will hopefully “reignite the construction industry nationally, making housing affordable again for families,” he says.

Despite the potential bright spots in the future of the supply sector, Freitas also expresses concern about the recent opening of a new Home Depot in Mapunapuna, where CMH is also located, and the impending opening of an Amazon warehouse facility on Sand Island later this year.

To what degree these additions will impact local suppliers remains to be seen, but it seems likely that smaller suppliers, like the nearly 55-year-old company started by Freitas’ father, could feel their effects faster.

“It could be a good thing and it could be a bad thing, she muses. “Only time will tell.”

Bauer sees further hope in public-private partnerships to create locally-made, factory-built housing. He says these arrangements have ”the potential to make a tremendous difference in addressing the need for more housing.”

To this end, he points to the recently completed Sacred Heart Affordable Housing Project (SHAHP) in Pāhoa on Hawai‘i island, built in conjunction with local nonprofit HOPE Services.

“Factory-built housing can significantly reduce construction costs while maintaining consistent quality, and we hope that SHAHP inspires other communities by showing what is possible,” he says.

SOWING SEEDS FOR THE NEXT GENERATION

Both Honsador and HPM offer scholarship programs to invest in the future of the industry.

Bauer says HPM’s program, the Building Future Builders Scholarship, is available to all second-year carpentry students at University of Hawai‘i Community Colleges statewide.

Honsador operates the High School Hero scholarship program, as well as running or offering support for other local programs.

“The disruption caused by the pandemic shone a light on the building industry as part of the backbone of our state and a consistent economic driver amid unprecedented circumstances,” says Bauer. “I hope that the next generation feels inspired by the difference they can make through the diverse careers in our sector.

“Ultimately, the day-to-day work that we do to supply projects has a far-reaching impact by enabling the construction of the homes and facilities that our community needs to thrive.”

The resiliency of the local construction industry rests largely on the shoulders of its suppliers. Projects can’t get built without the materials to build them, after all, so suppliers are invaluable both for their unique perspective on the industry‘s current health, as well as their role in where it goes from here.

Where does it go from here? As Freitas says, “only time will tell.”

Editor’s Note: In the print version of this story appearing in the Jan. 2024 issue of Building Industry Hawaii, the scholarship programs discussed were attributed to the incorrect companies. The error has been corrected in the online version and a correction will be run in a future issue of the print

magazine.