Supply-chain issues are still sidelining delivery of new paint to the Islands, but that hasn’t shut down Hawaii painting projects.

If anything, demand for painting services is rising. “The current market for painting continues to look strong,” says Dean Nagatoshi, executive director of Painting and Decorating Contractors Association (PDCA) of Hawaii.

That said, top local painters, while happy that their work schedules are full, are not so pleased when it comes to dealing with Hawaii’s supply-chain issues.

Building Industry Hawaii spoke to five local painting leaders—Nagatoshi (PDCA of Hawaii), Sheldon Ibara (business development manager, JD Painting & Decorating Inc.), Sean Dunham (estimator-project manager, Kawika’s Painting Inc.), Rodd Shimamoto (president, Raymond’s Painting Company Inc.) and Jesse Taylor (vice president of operations, The Zelinsky Company)—for their views

on current industry trends, challenges and opportunities.

What new paints and formulas are available in Hawaii right now?

Ibara: Anti-viral and anti-bacterial paints have emerged recently in the Hawaii market to combat the effects of the pandemic. Two such products, PPG Copper Armor and Behr Copper Force, are EPA-registered and kill 99.9% of viruses and bacteria within two hours of exposure on interior painted surfaces. They also continuously kill viruses and bacteria for up to five years with proper cleaning and maintenance.

Taylor: Recently, there seems to be a trend in manufacturers either producing new products or reformulating existing latex paints to be 100% acrylic. In the past, many interior paints were vinyl acrylic or styrene acrylic. Manufacturers are labeling and utilizing many of the 100% acrylic paints as “self-priming” due to the better-quality resin.

Are low-VOC paints being used on most current projects?

Taylor: For the most part, all current projects have low-VOC products being applied in the commercial painting segment. This change is due to specifica- tions and coating manufacturers reformulating many of their core products to be low-VOC over the last 10 years.

Ibara: Most of the top-selling, commercial-grade primers and paints today are manufactured as low-VOC products (50 g/L). Therefore, specifying a paint that is low-VOC has become standard practice.

Shimamoto: No—because low-VOC paints typically cost more and have less coverage.

Dunham: Interior, yes. Exterior—no!

Which exterior paints perform best in our high-UV and marine environment?

Taylor: Looking at exterior paints, we have seen manufacturers improve their colorants/pigments to provide better color retention—which is important in our coastal marine environment because paints and coatings break down quicker when exposed to intense ultraviolet light.

Shimamoto: All paint brands have higher-grade paints that are available, and are suitable for Hawaii’s high UV and marine environment. But they need to be the higher-grade paints from each supplier. We would typically use all of these paints, which we would switch out per project.

Dunham: Most manufactures have multiple lines of varying quality and cost. As long as you stay away from the low end of their lines, you are in good shape. We also remind clients that paint is aesthetic and just because it may last longer, the high-end paints still get dirty and fade. Prep is still the biggest factor in the longevity of any paint job.

Are new coatings for particular surfaces and substrates—for example, concrete, masonry and metal—available now?

Shimamoto: There aren’t any new prepping and coating products available that we are aware of.

Which new interior paints seem best-suited for Hawaii’s residential and commercial projects? What interior colors are most popular now?

Dunham: Almost all interior paints are latex (waterborne). Most suppliers have excellent products. The bigger issue is choosing the right sheen/gloss level and the quality of the drywall below. Interior paint at 1.5- to 3-thousandths of an inch thick cannot cover previous sins.

Shimamoto: All paint brands that are available are best-suited for Hawaii’s residential and commercial projects, as long as you use the higher-grade paints of each brand.

Ibara: Gray-green is predominately the top color pick of the year. The 2022 Color of the Year, as selected by PPG, Sherwin-Williams and Benjamin Moore are PPG1125-4 Olive Sprig, SW 9130 Evergreen Fog and October Mist 1495, respectively.

Are you offering new services in 2022-2023?

Ibara: Earlier this year, JD Painting acquired Honolulu Painting, a company with a long history in the paint industry since 1946. With this new partnership, JD Painting has expanded its portfolio to include sandblasting, industrial coating and resinous flooring work.

Taylor: We recently received QP-1 certification from the Association for Materials Protection and Performance (AMPP). This certification is required for many federal and industrial coatings projects.

Dunham: We continue to try and educate clients on the importance of prep and repairing the substrate below so that their new paint can look good and keep the weather out for years to come.

How are supply-chain issues impacting Hawaii’s painting industry?

Dunham: Most of the architectural paint manufactures are still catching up on their backlog due to COVID, shipping and raw material shortages, so they have not introduced much in the way of new products.

Ibara: Due to the raw materials and supply chain shortages, paint companies have been busy trying to keep up with demands to produce existing product lines. As a result, current emphasis has not been to manufacture new products until inventory stabilizes to normal stocking levels.

Shimamoto: As the market/supply-chain woes grow, it lessens the amount that’s currently available. Certain paint lines are not being made until further notice.

Nagatoshi: The painting market in Hawaii has been affected by price increases and continues to be challenged with supply chain issues of material availability that have resulted in more than one paint supplier’s materials being used on a single project. Painting contractors have had to be creative in finding ways to complete their projects.

What painting sectors

are most active right now?

Nagatoshi: The public and military sectors have been active in 2022 and look to continue into 2023. The housing sector has also been steady and should continue due to the need for more housing in Hawaii. The private, hospitality and commercial sectors have also been strong.

Ibara: The AOAO (condominium, townhouse) repaint market appears to remain optimistic heading into 2023.

What’s your outlook for Hawaii’s painting industry in 2022-2023?

Shimamoto: Very limited, as paints are starting to become scarce, and labor is as well.

Ibara: Shipping challenges, labor and raw material shortages, which currently limit paint production, will hopefully improve to allow delayed projects to start up in 2023.

Dunham: Very strong market.

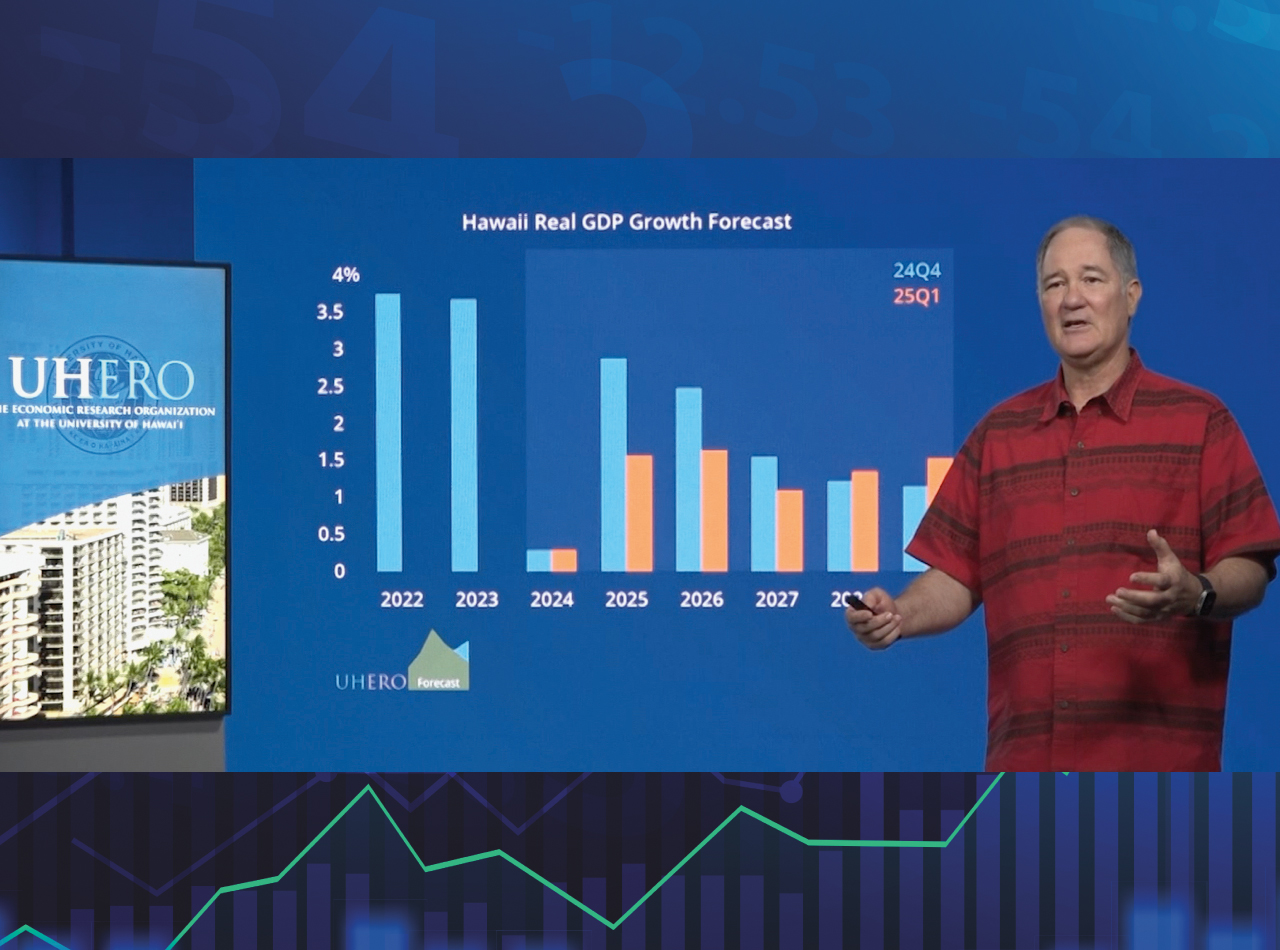

Taylor: At the moment and through 2023, construction looks strong. But beyond that, rising interest rates, cost of goods and inflation could affect funding of construction projects, especially privately funded projects.

Nagatoshi: Material costs are continuing to escalate as noted by a recent notice from the General Contractors Association Hawaii, “Alert: Concrete Prices Expected to Increase by Up to 35% in 2023.”

The increasing interest rates are concerning and may affect the start of future development. Permit issuance delays have also been an issue for projects that have required repairs prior to painting, and result in project cost increases.

These cost increases may negatively affect future projects from coming to fruition and place burdens on contractors with ongoing projects that have yet to be completed.

Although there are challenges ahead that may affect how much work the industry will be able to complete in 2023, the construction market continues to be strong, and we anticipate it resulting in continued opportunities for Hawaii’s painting industry.

CAPTION: Kapiolani Manor, a recent 27-story project near Ala Moana by Raymond’s Painting Co.

PHOTO COURTESY RAYMOND’S PAINTING CO. INC.