C

onstruction is booming while the effects of tariffs loom large. Falling interest rates mean more cash for projects, but a labor shortage means there’s no one to perform the work.

If there’s one constant, it’s that the construction industry has always seen its ups and downs — and 2025 looks to be no different.

Another constant is buildings still need to be built, repairs and upgrades still need to be made and walls and surfaces still need to be painted, regardless of market conditions.

No trade or specialty is immune to whatever shifts may come, as veterans and newcomers in the painting and supply sectors share their thoughts with Building Industry Hawai‘i as they look to the year ahead and beyond.

EMERALD PAINTING LLC

Emerald Painting has been in business for approximately a decade, a relative newcomer to the industry. The company specializes in residential and commercial projects, tackling both exterior and interior applications for single-family homes, condominium towers, medical facilities, houses of worship and several categories of properties in between.

Currently, Emerald Painting is about “halfway through” a 28-building project at Lalea at Hawaii Kai where Jace Takara, their foreman, is doing an “amazing job,” according to Emerald Painting Project Manager Casey Kimura.

Kimura says this year has presented some challenges, mostly in ways of weather.

“In painting, a lot is weather-related and our winter is running out pretty long this year,” he says.

However, as Kimura looks beyond the winter weather and Emerald’s work on Lalea, he sees reasons to be optimistic.

When asked about possible economic shifts caused by tariffs and federal spending cuts, Kimura says he “ultimately would like to see all of these things benefit the construction industry throughout Hawai‘i and the nation.

“Federal tax dollars should stay in America and benefit the taxpayers. We are excited to see what this year brings.

“Though we can’t be sure what to make of the political and economic landscape shifting just yet, [Emerald Painting] will keep a positive outlook and continue to work with aloha, professionalism and quality,” Kimura says.

JADE PAINTING INC.

Donald W. Ka‘anapu Jr., an estimator with Jade Painting Inc., has a similar sense of optimism couched in caution.

“We’ve been blessed to have a post-COVID construction boom, but we’re currently experiencing a lack of available workforce to aid the surge,” says Ka‘anapu. “However, there may be a possibility that federal employee cuts could shift personnel our way. We’re also optimistic that the potential economic shifts will help drive down inflation, thus allowing for the redirection of funds to trickle down into the correct sectors, limiting waste.”

Ka‘anapu says that “[o]ver the years, Jade has been blessed with numerous significant projects,” including exterior work on the Hawai‘i Convention Center, which got underway in July 2024 and is still ongoing.

Jade, which has been around since 1974, has also worked on numerous residential and commercial projects across the state, including high-profile projects like Azure and The Ritz-Carlton Residences, Waikiki Beach, as well as military projects and educational institutions.

In its 50 years, Jade has seen its share of trends, including recent shifts due to the housing crunch.

“We’re seeing the painting industry trend towards a combination of new high-rise construction and business building spaces converted to include residential units to help address the current housing crisis in Hawai‘i,” Ka‘anapu says.

Ka‘anapu has a positive outlook for the industry’s future due to the current investor focus on the housing crisis.

“By building multi-use high-rises and multi-level townhomes, [we] maximize the use of limited amounts of land,” he says.

Ka‘anapu also makes note of trends occurring on the product side of things, seeing manufacturers and suppliers providing “an array of innovative products specifically to assist the everyday home painter and large painting companies that focus on production in construction.”

HPM BUILDING SUPPLY

Diana Ancog, paint manager at the Kona location of 104-year-old HPM Building Supply, is also seeing innovation and novelty in current paint offerings.

“We’re witnessing a marked shift toward bold exterior color selections in both residential and commercial projects,” says Ancog. “Dark grays, blacks, navy blues and forest greens are replacing the traditional island palette of beige, off-white and light green.

“Professional contractors and architects are implementing more sophisticated color strategies, such as Benjamin Moore’s Onyx 2133-10 for main surfaces, Chantilly Lace OC-65 for trim elements and Hamilton Blue HC-191 for architectural details like fascia and soffits — creating more distinctive building profiles across Hawai‘i’s construction landscape.”

Ancog also highlights Benjamin Moore Element Guard for exteriors, which holds up in high-humidity environments.

“Its specialized resin technology provides rain resistance within 60 minutes of application — a significant advantage for contractors working with Hawai‘i’s unpredictable weather patterns,” she says.

Ancog, along with HPM Buyer Aaron Auna, express cautious optimism.

“Hawai‘i’s construction and painting sectors face a complex outlook,” says Ancog.

“The 12-percent increase in construction jobs through Q3 2024 reported by [the Department of Business, Economic Development & Tourism] indicates strong demand, but the industry-wide skilled labor shortage threatens to extend project timelines and inflate costs for developers and contractors throughout the islands,” says Auna.

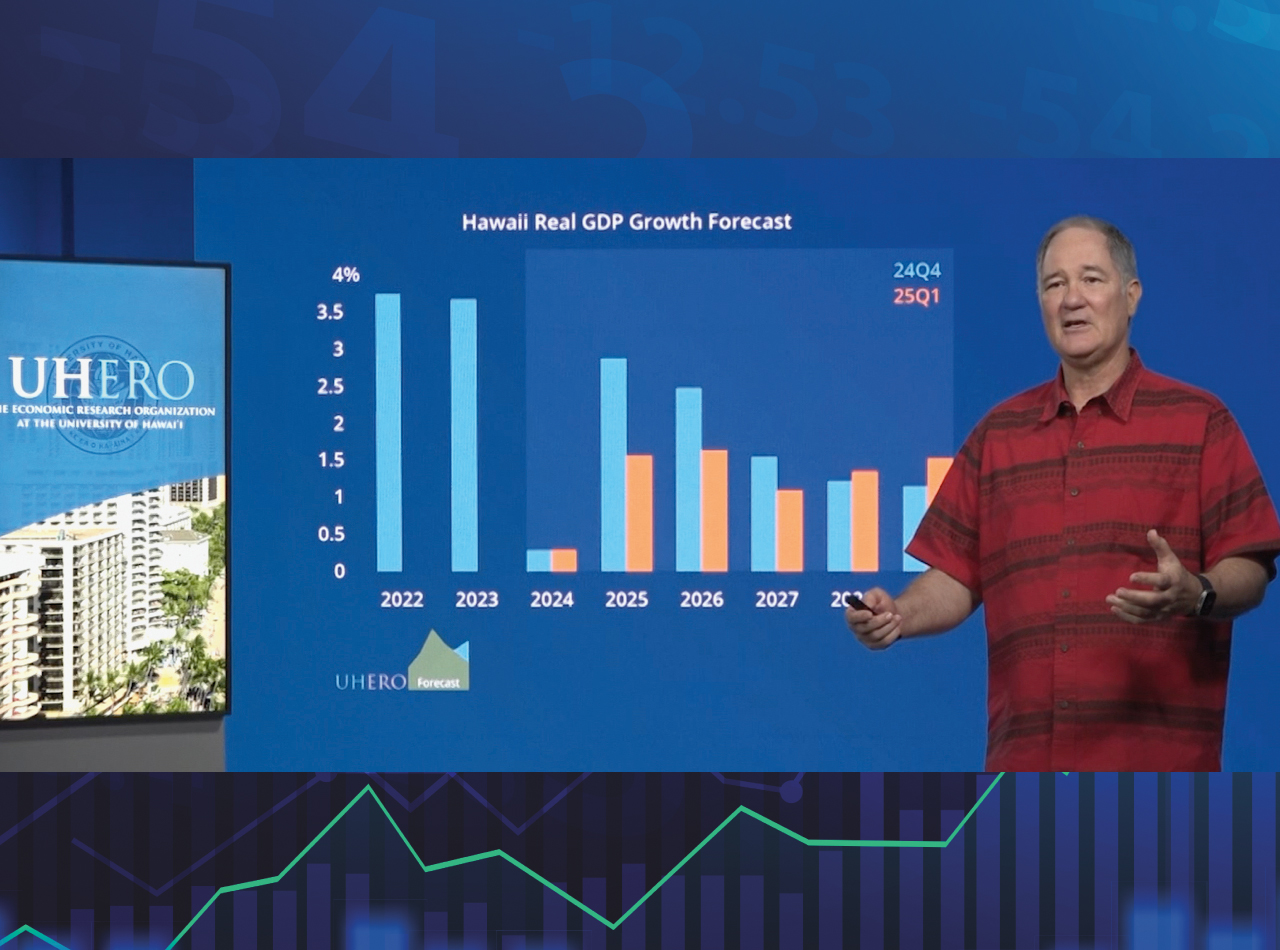

Auna goes on to point out the potential for additional painting contracts in the public and commercial sectors due to the 2-percent growth forecast by the DBEDT for Hawai‘i in 2025 but also notes that federally imposed tariffs and evolving trade policies with foreign partners may have impacts on the availability and costs of materials.

“We’re also monitoring the impact of rising insurance costs on development,” an ongoing crisis as properties find themselves in dire financial straits as they try to balance their books while giving needed attention to maintenance and renovation projects, he says.

As the painting sector prepares for the worst while hoping for the best, there is a bright spot on the consumer side of the equation, as modern tools give clients access to a wider base of knowledge.

“The evolving sophistication of homeowner knowledge has transformed our industry,” Ancog says. “Two decades ago, retail customers needed extensive guidance on product selection, application methods and tool requirements. Today’s customers, influenced by digital resources, arrive with specific product knowledge and application understanding.

“However this creates a new challenge for building professionals: while technical knowledge has increased, color selection remains a significant hurdle, requiring more consultation time from both suppliers and contractors to achieve the desired aesthetic outcomes for finished projects,” she adds.