Terence Young, Rider Levett Bucknall (RLB) Hawaii region principal, says builders should prepare for the impact of new 2025 tariffs on the state’s construction industry.

Terence Young

However, the impact of U.S. tariffs on steel and aluminum is expected to be “manageable,” he says.

“This is because the costs of construction materials, such as steel and aluminum, are only a portion of the overall construction costs of a project, while labor and equipment costs remain unaffected by tariffs.”

Young says RLB anticipates “supply chain disruptions due to the new U.S. tariffs.”

He says Hawai‘i developers and general contractors (GCs) will start feeling the tariffs’ impact “almost immediately” to projects that were bought out a year ago or are planned for the future.

The tariffs will primarily impact developers, who will bear the increased costs.

Suggesting developers and project teams can consider alternative sourcing strategies, Young cites the transition from Chinese-made products to those from Vietnam and Indonesia during the first Trump administration.

“This transition led to schedule impacts and longer lead times as these regions became overloaded with orders,” says Young.

ALL SECTORS AFFECTED

Every building sector will be affected by new U.S. tariffs, Young says.

“High-rise construction will likely be the most impacted due to its larger scale and reliance on materials like aluminum for facades and other building components,” he says. “In contrast, renovations may see less impact as they typically require fewer inputs of affected materials.

“Looking at sectors such as hospitality and other residential product types — furniture, fixtures and equipment, which are significant components of these projects — will likely experience increased costs as they are often products sourced from tariff-impacted regions.”

There are other factors in play that can also affect a company’s bottom line.

“Tariffs can reduce general contractors’ profit margins in several ways,” Young continues.

For example, tariffs can force developers to cancel or delay projects, thereby cutting the supply of available work. GCs then bid more competitively.

“Competitive bidding often means reducing profit margins, as material, labor and equipment costs remain fixed,” says Young. “Future projects, especially those not yet contracted, will be more affected as all bidders source materials from the same suppliers and face similar tariff costs.”

THE ‘BUY AMERICA’ OPTION

“Hawai‘i developers, engineers, architects and general contractors can specify ‘Buy America’ steel and aluminum in their project specifications to avoid the effects of new tariffs,” Young says. “However, they will still face some premium costs.

“The purpose of tariffs is to increase domestic market share, which raises demand for domestic products,” he explains. “This increased demand can lead to higher prices if domestic manufacturers lack the capacity to meet it.”

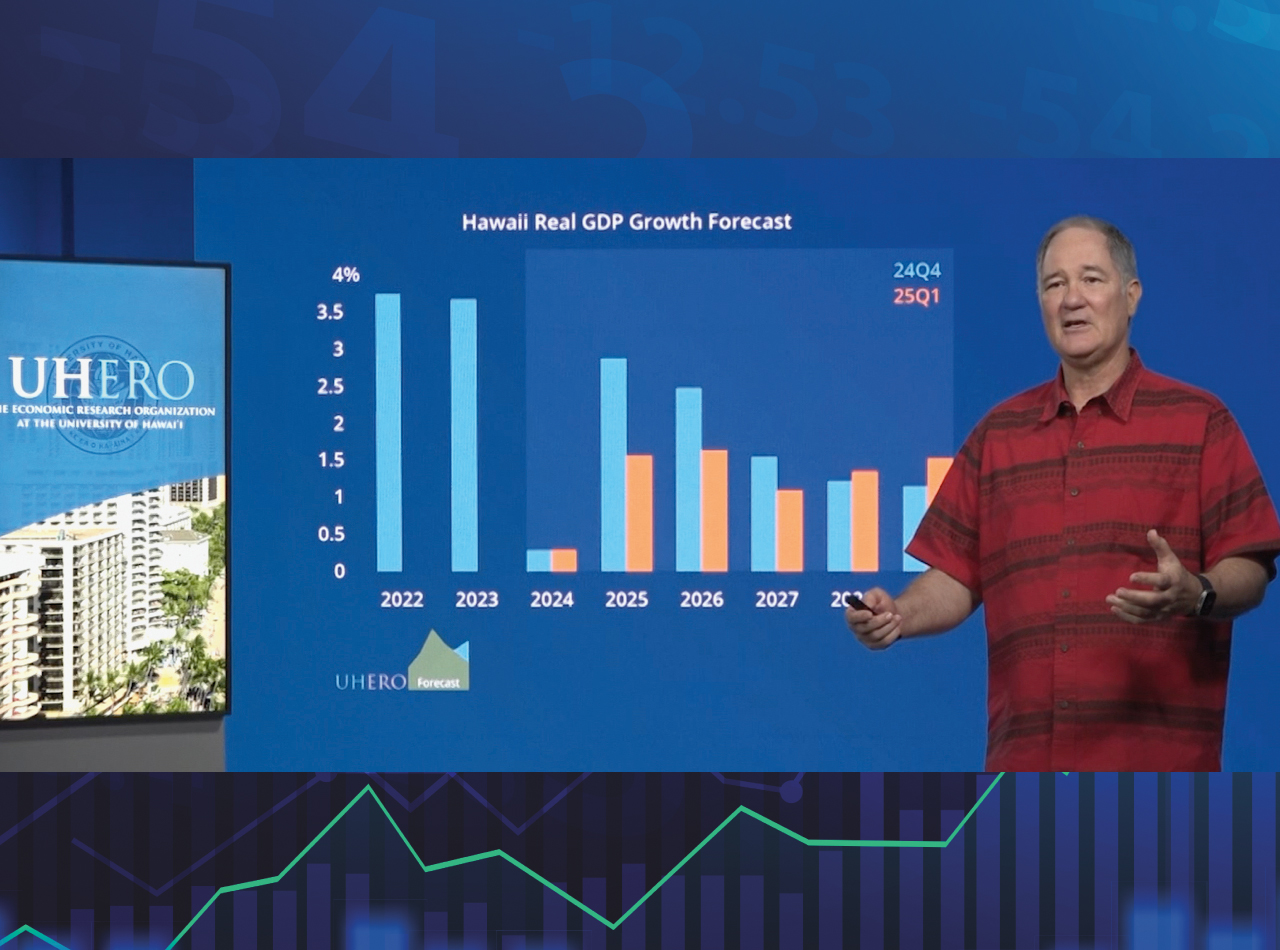

In February, Carl Bonham, University of Hawai‘i Economic Research Organization (UHERO) executive director, addressed the impact of new tariffs and other economic pressures.

“It looks like [new federal] policies will weigh on Hawai‘i’s economy and slow Hawai‘i’s economic growth in 2025 and 2026,” Bonham said during a presentation.

“It’s also cuts to contracts, grants, putting these on pause,” he added. “And that will affect payroll jobs across many, many sectors in Hawai‘i, from healthcare to the University of Hawai‘i, state and local government, are potentially, could be, facing some drag because of lost federal spending.”

Looking ahead, UHERO is readjusting its outlook for the rest of the year.

“Our forecast for 2025 is for roughly 1.5 percent real GDP growth, down from 3 percent,” Bonham said. “That’s because of the lost employment, the lost spending, across the entire state and across multiple industries.”

Bonham emphasized Hawai‘i’s reduced GDP growth outlook does not indicate a coming recession. Citing Hawai‘i construction as a bright spot in the state’s economy, he said construction jobs “will probably peak around 41,000 workers in 2026,” a record high.

Young is also optimistic.

“The impact of the new tariffs is expected to be manageable, as past tariffs aimed at increasing domestic production did not cause extreme cost disruptions,” he says. “Hawai‘i’s construction industry has shown remarkable resilience in adapting to evolving challenges, continually finding innovative ways to deliver projects and keep the economy moving.”