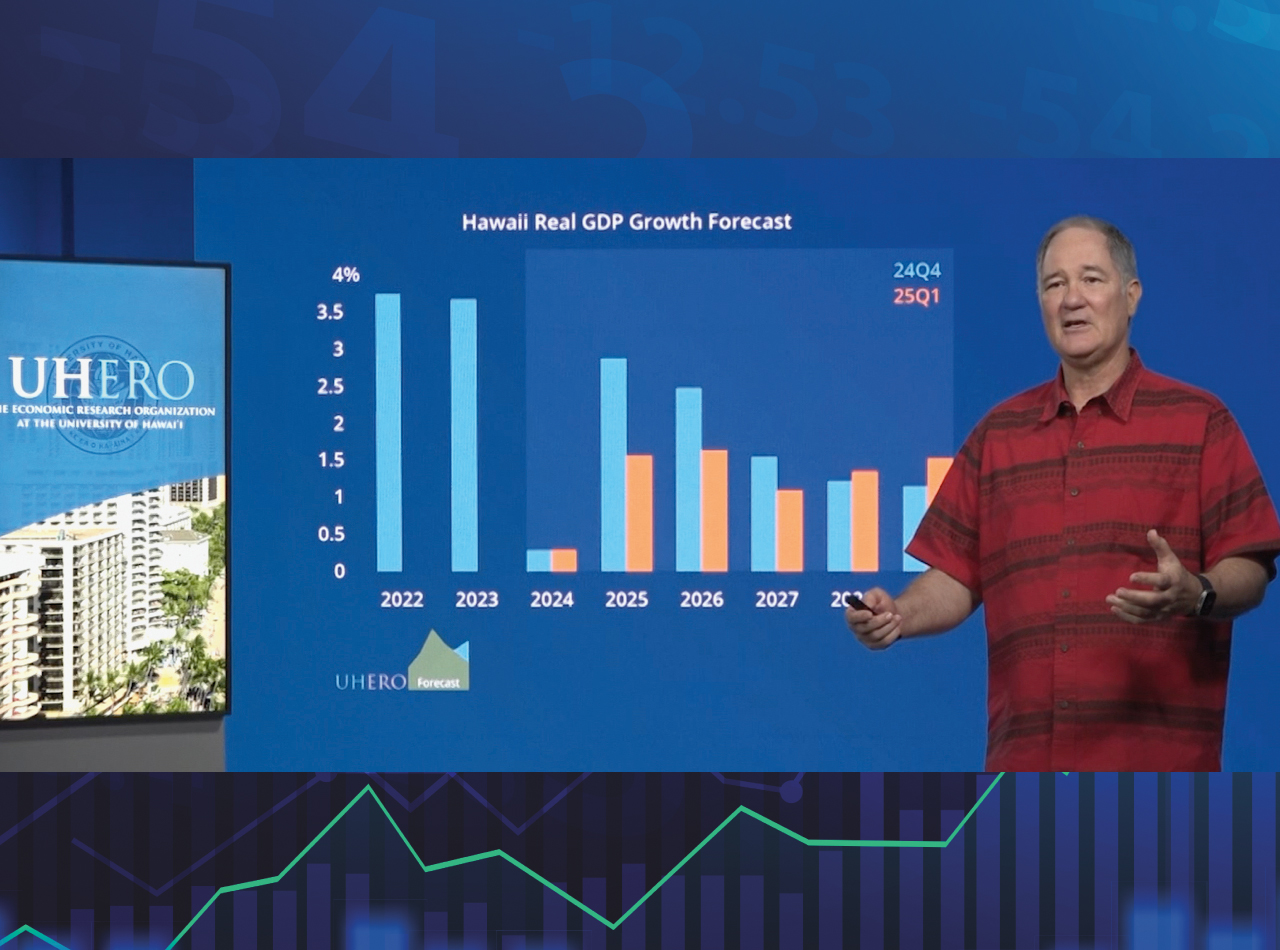

Hawai‘i contractors are getting their share of bad news in 2025.

New tariffs are expected to dramatically increase the cost of building materials, high interest rates are curbing residential construction and inflation may raise the price of energy and other essential goods.

But Hawai‘i contractors have one bright spot: while condominium and other homeowner insurance rates are skyrocketing, rates for casualty insurance policies are holding steady — for now.

“The casualty market is not seeing the same reinsurance hurdles as the property market, but the casualty market is not immune to inflationary pressures,” says Dylan Nakano, vice president, Atlas Insurance Agency commercial lines and sales unit. He adds that “specific to contractors, the casualty market is also dealing with increased frequency and severity of construction defect allegations, primarily on for-sale residential projects.”

Jason Kott, president at King & Neel LLC, sees similar trends. “Significant verdicts/settlements are on the rise in Hawai‘i,” he notes. “The cost of construction and the costs of litigation have increased significantly since COVID.”

Going forward, both inflation and litigation have the potential to push

contractors’ insurance rates higher.

INSURANCE POLICIES TO WATCH

Right now, contractors have the benefit of stable rates when reviewing their existing insurance programs and considering new ones.

“Contractors should review their insurance program with their insurance agent no less than annually to discuss changes to their operations, the state of the insurance market, contractual risk transfer benchmarking and short-term/long-term strategies for their insurance program,” Nakano says.

“From a Hawai‘i contractor’s self-review standpoint,” adds Kott, “coverage limits remain the focus for review and potential strengthening.”

Kott recommends coverage limits be reviewed in the following categories:

Insurance Policies Mandated by Law:

• General Liability

• Automobile Liability

• Workers’ Compensation

• Employers’ Liability.

Insurance Policies More Common for a Contractor or Business (May be Contractually Required):

• Umbrella/Excess Liability

• Property coverage that includes Builder’s Risk/Installation Floaters/Inland Marine, Contractor’s Equipment, Contractor’s Pollution Liability, Contractor’s Professional Liability and Ocean Cargo Marine Liability.

Insurance Policies More Selectively Procured but Rising in Importance:

• Cyber Liability

• Management Liability (Directors & Officers/Fiduciary/Employment Practice Liability)

• Discontinued Operations

• Keyman/Keyperson

• Crime.

Kott notes that for annual commercial General Liability and other related annual liability policies, “insurers and their reinsurers remain stable.

“If anything, we’ve seen a few markets/insurers provide updates to coverage forms and endorsements that provide some enhancements or increased benefits to the contractors as their insureds.”

COVERAGE FOR SUBCONTRACTORS

Hawai‘i subcontractors are currently adapting to stricter bonding terms, but likely won’t face “more stringent subcontractor insurance coverage or limit requirements in 2025,” Kott says

“I think lenders, owner/developers and Hawai‘i’s general contractors have been diligent in updating their insurance requirements over the past few years,” he says. “And with a steady, productive construction economy, subcontractors have been less resistant to meeting those limits and requirements, creating less friction and more alignment over insurance.

“That said, I think those subs that have habitually argued for lesser limits or coverage than required may find 2025 as a turning point,” he says.

WHAT INSURERS LOOK FOR

When issuing a contractor’s insurance policy, Nakano says insurance companies must determine the extent to which the contractor fits with the underwriting appetite of the insurer — namely, the size of the contractor’s operation, the trades that are self-performed and whether the applicant is a general contractor that subcontracts or a subcontractor who works with general contractors.

“A contractor’s claims history — frequency and severity of claims and the safety culture of the contractor — is also taken into account,” he says.

Kott agrees. Once an agent identifies the insurers that align with his or her client, “the focus is on loss history, revenue and payroll amounts, experience/company history, mix of projects, self-performed versus subcontracted work [and other factors],” he says.

One deciding factor can be “construction for habitational [projects, which] is viewed as a higher risk,” Nakano reports. “Insurers evaluate the specific type of habitational project — condo, rental apartment, single-family home, townhome — how much work is performed on a habitation project, and whether such habitational work is new construction (ground up) or renovation.”

Kott emphasizes that thorough documentation and the close collaboration between agent and applicant are exactly why contractors need to seek out a good construction agent or agency.

“They will excel at identifying, negotiating and partnering the right client with the right insurer(s),” he says.